Did you know that 82% of small businesses fail due to cash flow problems, according to SCORE? One major factor contributing to these issues is how expenses are managed. Poor expense management can lead to revenue losses of up to 5%, making tracking all costs—fixed, variable, and periodic expenses essential.

Understanding the distinctions between these categories is crucial for maintaining a healthy cash flow. By differentiating between fixed, variable, and periodic expenses, you can effectively manage your finances, identify cost-saving opportunities, and protect your bottom line.

In this blog, you'll explore the concept of periodic expenses, why budgeting for them is essential, and how understanding the differences between periodic, fixed, and variable costs can help you make better financial decisions. You'll also discover practical strategies for managing these expenses to keep your financial goals on track.

Understanding Fixed, Variable, and Periodic Expenses

Business expenses are the costs incurred during a company's normal day-to-day operations.

Any cost directly related to running your business – whether incurred by you, your employees, or the company itself – should be recorded as a business expense. These costs are fundamental to your business's operation and, ultimately, its financial reporting and tax payments.

In the UAE, businesses often categorise expenses into three key types: fixed, variable, and periodic. Each type affects the budgeting process differently, so finance teams must diligently track and forecast these costs.

Fixed expenses remain constant, while variable expenses fluctuate based on activity levels. Periodic expenses occur irregularly but can be anticipated, making it crucial to include them in your financial planning.

By understanding these distinctions, finance teams can better track and forecast costs, ultimately leading to improved financial management and more informed decision-making for the business.

[cta-3]

What are Fixed Expenses?

Fixed expenses do not change with the level of business activity. They are predictable, allowing businesses to plan effectively. For instance, while factors like service provider changes or increased rent can occasionally impact them, most fixed expenses occur on a scheduled basis—monthly, quarterly, or annually.

Fixed expenses are crucial for businesses because they form the foundation of their financial commitments.

Consider an auto insurance premium paid twice a year. By dividing the total amount by six, you can easily incorporate it into your monthly budget. This foresight aids in financial planning and helps avoid surprises at payment time.

Fixed expenses include:

- Mortgage Payments: These are often the most significant fixed expense for homeowners and businesses alike, creating a steady outflow that needs to be accounted for.

- Car Loans: Monthly payments remain constant, enabling individuals and businesses to budget effectively.

- Insurance Premiums: Fixed in nature, these can cover property, health, or liability, ensuring protection against unforeseen circumstances.

From a business perspective, fixed expenses form the backbone of daily operations. They remain due regardless of the number of products or services sold, which means that they significantly influence a company's overall profitability.

The Importance of Fixed Expenses

Understanding fixed expenses is vital for several reasons:

- Financial Stability: Fixed expenses provide a predictable financial landscape, allowing businesses to strategise for growth without worrying about sudden cost fluctuations.

- Investment Insights: Investors often look at fixed expenses to assess a company's operational efficiency. High fixed expenses suggest a need for increased sales to maintain profitability, while lower fixed expenses can indicate more flexible business operations.

- Budgeting: By knowing their fixed expenses, businesses can allocate resources effectively and ensure they have enough liquidity to cover these obligations.

Examples of Fixed Expenses

Here are some common fixed expenses faced by businesses, illustrating their constant nature regardless of production output:

- Commercial Rent: Typically, commercial leases have fixed monthly or annual amounts. This expense remains unchanged during the lease agreement, making it easy to plan for.

- Online Advertising: If a business allocates a budget of AED 10,000 for online advertising, this amount remains unchanged throughout the advertising period, serving as a fixed expense that aids in strategic planning.

- Insurance Premiums: These costs provide essential coverage for property and assets. While certain types of insurance may vary based on specific needs (e.g., worker compensation), many premiums are fixed and predictable.

- Depreciation: This is an accounting method that allocates the cost of tangible assets over their useful lives. For example, a company may estimate the depreciation of its machinery, which remains constant and predictable each month.

- Property Taxes: These expenses are typically fixed for a financial year, allowing businesses to factor them into their annual budget.

Typical day-to-day non-business fixed expenses include:

- Rent or mortgage payments

- Insurance premiums

- Car payments

- Real estate taxes

- Phone and utility bills

- Childcare and tuition fees

- Gym memberships

Are Fixed Expenses Considered Sunk Costs?

In financial accounting, all sunk costs are classified as fixed expenses, but not all fixed expenses are considered sunk.

For example, when a company invests in production machinery, this is a fixed expense. However, it is not a sunk cost because the machinery can be sold to recover some or all of the initial investment.

Conversely, monthly fuel expenses for a company’s fleet represent a sunk cost. Once incurred, these expenses cannot be recouped, making them less flexible in financial planning.

What are Variable Expenses?

Variable expenses are costs that fluctuate based on the volume of products or services a business produces. Unlike fixed expenses, which remain constant regardless of your production levels, variable expenses rise and fall in line with your output.

Simply put, when production increases, variable expenses also increase; when production decreases, these expenses drop.

To calculate variable costs, businesses use the formula:

Total variable cost = Total quantity of output x Variable cost per unit of output

However, it’s important to note that variable expenses can vary significantly across different industries. For example, comparing the variable expenses of a car manufacturer to those of an appliance maker may not yield meaningful insights, as their production processes and outputs differ significantly. It's best to benchmark against similar businesses within your industry.

[cta-4]

The Importance of Variable Expenses

Understanding variable expenses is crucial for investors and business owners alike. Here’s why :

- Impact on Profitability: These costs directly affect your bottom line. If your variable expenses rise unexpectedly, it can significantly reduce your profits, impacting your overall financial health.

- Budget Planning: Analysing past spending on variable expenses allows you to estimate future costs better, allowing for improved financial planning.

For example, consider a hypothetical scenario where your company manufactures 1,000 vehicles for AED 18,000 each. This results in a total variable expense of AED 18 million. If you face material shortages the following year and can only produce 400 vehicles at a higher cost of AED 29,000 each, your total variable expense would drop to AED 11.6 million. This illustrates how fluctuations in production levels can impact your overall costs and profitability.

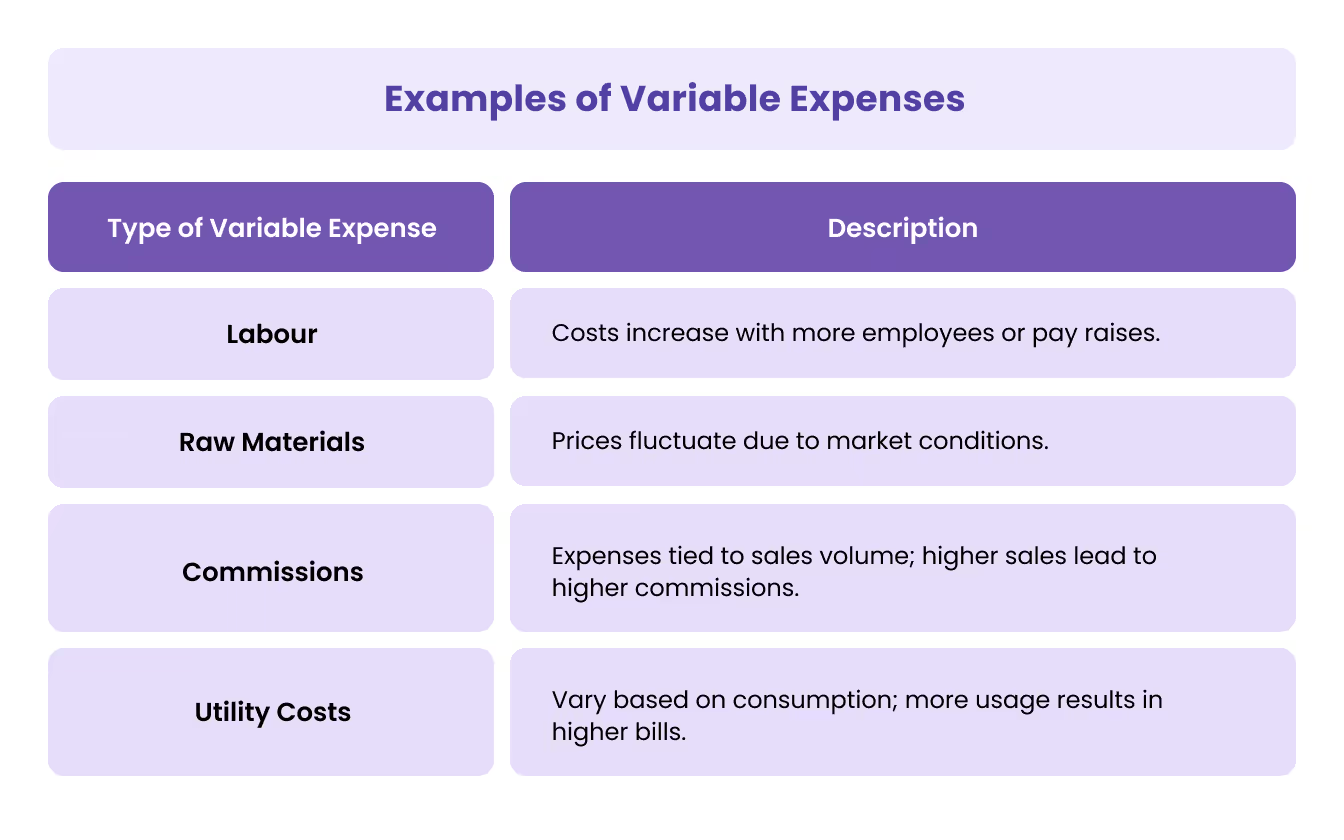

Examples of Variable Expenses

Variable expenses can include various costs that vary depending on business activity. Here are some common examples:

Outside of a commercial environment, typical variable expenses include:

- Food and dining out

- Clothing purchases

- Fuel for vehicles

- Personal care items

- Entertainment expenses

- Repairs for automobiles and homes

- Medical expenses

Is Marginal Cost the Same as Variable Cost?

While all variable costs can be considered part of marginal costs, they are not the same. Variable costs are expenses that change based on production levels; for instance, as you produce more items, your costs for raw materials increase.

On the other hand, marginal cost refers explicitly to the additional expense incurred when producing one more unit of output. So, if you're already making 100 items and decide to produce one more, the marginal cost is the cost associated with that extra item.

In essence, while all variable costs contribute to the marginal cost, the marginal cost focuses solely on the cost of producing that additional unit. Understanding both helps businesses effectively manage their finances.

How to Save on Fixed and Variable Expenses

Understanding how to manage fixed and variable expenses can lead to significant savings in your budget. Let’s explore effective strategies for reducing each type of expense.

Saving on Fixed Expenses

Although termed "fixed," these expenses can often be adjusted. If you're facing financial challenges or simply want to save more, consider the following tips to reduce your fixed expenses:

- Negotiate Rent

Talk to your landlord about reducing rent in exchange for a longer lease commitment. If your current space is more than you need or too costly, consider moving to a smaller or more affordable location to save on rent.

- Reassess Loan and Lease Payments

If your monthly loan or lease payments put pressure on your cash flow, contact your bank or leasing company to renegotiate terms. Extending the loan period can lower monthly payments, but be cautious about long-term interest implications.

- Cut Insurance Costs

Investigate options to lower your premiums, such as installing security systems to mitigate risks. If you have a strong relationship with your insurance provider, don’t hesitate to negotiate for better rates.

- Streamline Management

Instead of hiring multiple managers, consider having a few well-qualified individuals oversee larger teams. This can help reduce salary costs while maintaining productivity.

Saving on Variable Expenses

Variable expenses can be more challenging to control as they fluctuate depending on your business activities. Here are practical strategies to help manage these costs effectively:

- Reduce Utility Usage

Monitor your electricity, water, and internet usage. Switch to lower-cost plans or providers, and ensure your staff is mindful of energy consumption. Regularly reviewing utility bills can reveal areas where you might be overspending.

- Optimise Shipping and Packaging

Streamline your shipping processes to reduce packaging and shipping expenses. Consolidate shipments when possible, minimise materials, and tailor package sizes to fit the products more efficiently.

- Maintain Minimum Bank Balances

Be aware of minimum balance requirements in your bank accounts to avoid unexpected fees. Keeping the required amount available can save you from incurring unnecessary charges.

- Pay Off Credit Card Balances Promptly

Develop a payment plan to pay off your credit cards fully and on time. This will help you avoid late fees and high-interest charges that can quickly accumulate.

Excellent Tip: Do you know about corporate cards? You can use a corporate card to manage each payment with complete control and visibility, all in one place, and earn unlimited 2% cashback on all international transactions.

By proactively managing both fixed and variable expenses, your business can improve its profitability and ensure long-term financial stability. In the next section, you will explore periodic expenses to enhance your expense management strategy further.

What Are Periodic Expenses?

Periodic expenses are infrequent or semi-regular and do not occur consistently monthly. They can arise quarterly or annually and often catch you off guard if not adequately planned.

Examples of periodic expenses include:

- Maintenance and repairs

- Merger and acquisition costs

- Major equipment purchases

Challenges of Planning for Periodic Expenses

Unlike fixed expenses, such as rent or monthly utility bills, periodic expenses don’t always come to mind during budgeting sessions. For instance, while you remember to account for your monthly bills, you might forget that property taxes, car registrations, or seasonal purchases will also require funds. This oversight can lead to budget shortfalls and financial stress when these expenses arise.

Hence, you should know how to budget for these expenses.

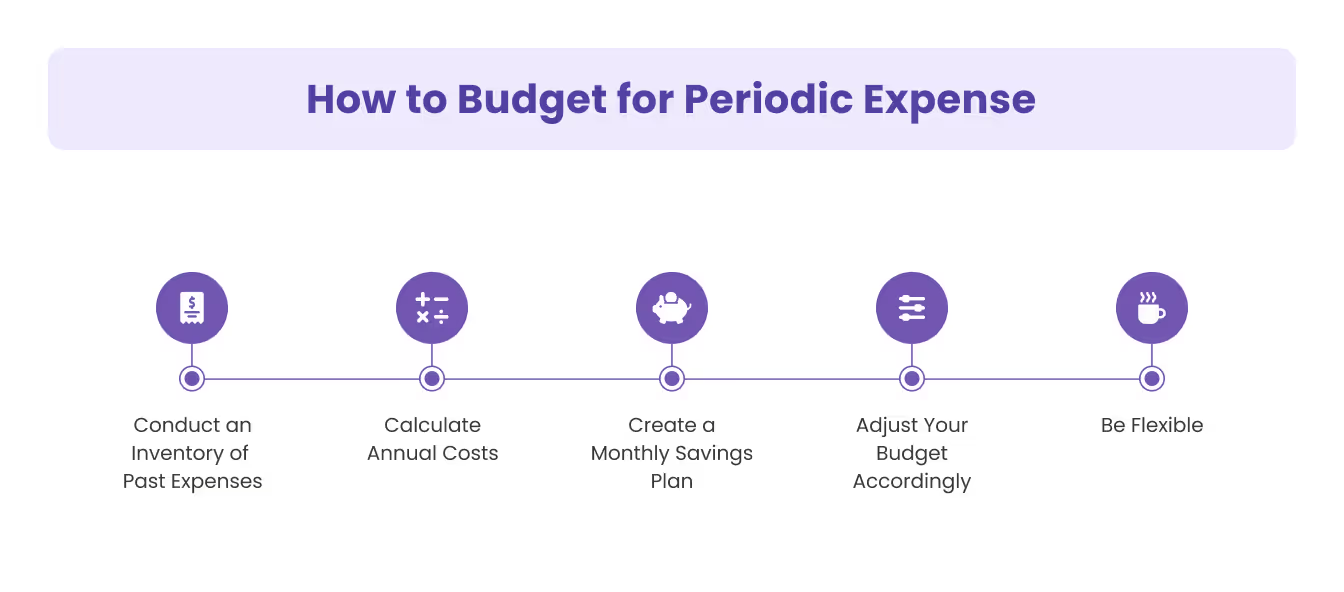

How to Budget for Periodic Expenses

- Conduct an Inventory of Past Expenses

Review the periodic expenses you incurred over the past year. This includes anything that isn’t classified as fixed or variable. Common periodic expenses include:

- Holiday gifts

- Annual subscriptions (like software or memberships)

- Maintenance costs for appliances, vehicles, or home repairs

- Calculate Annual Costs

Once you’ve identified your periodic expenses, total them up for the year. This total gives you a clear picture of what to expect.

- Create a Monthly Savings Plan

Divide the annual periodic expenses by 12 to determine how much you need to save each month. For example, if your periodic expenses for the year amount to AED 60,000, you should aim to save AED 5,000 monthly. This method ensures that you are financially prepared when these expenses arise.

- Adjust Your Budget Accordingly

Incorporate this monthly savings amount into your overall budget. This way, you’ll have the necessary funds set aside when a periodic expense comes due.

- Be Flexible

Keep in mind that budgeting for periodic expenses is an estimate. In some years, your expenses may exceed your savings; in others, you may have surplus funds. Adjust your plan as needed based on your spending habits and actual expenses.

By actively managing your periodic expenses, you can avoid the pitfalls of unexpected costs derailing your financial plans.

Managing all these expenses can be complex and tedious. Automating this can reduce payroll costs by up to 80%.

Alaan can help you streamline your expense management system and provide detailed insights into spending patterns, helping you achieve your budgeting goals.

Why It’s Important to Distinguish Between Fixed, Variable, and Periodic Expenses

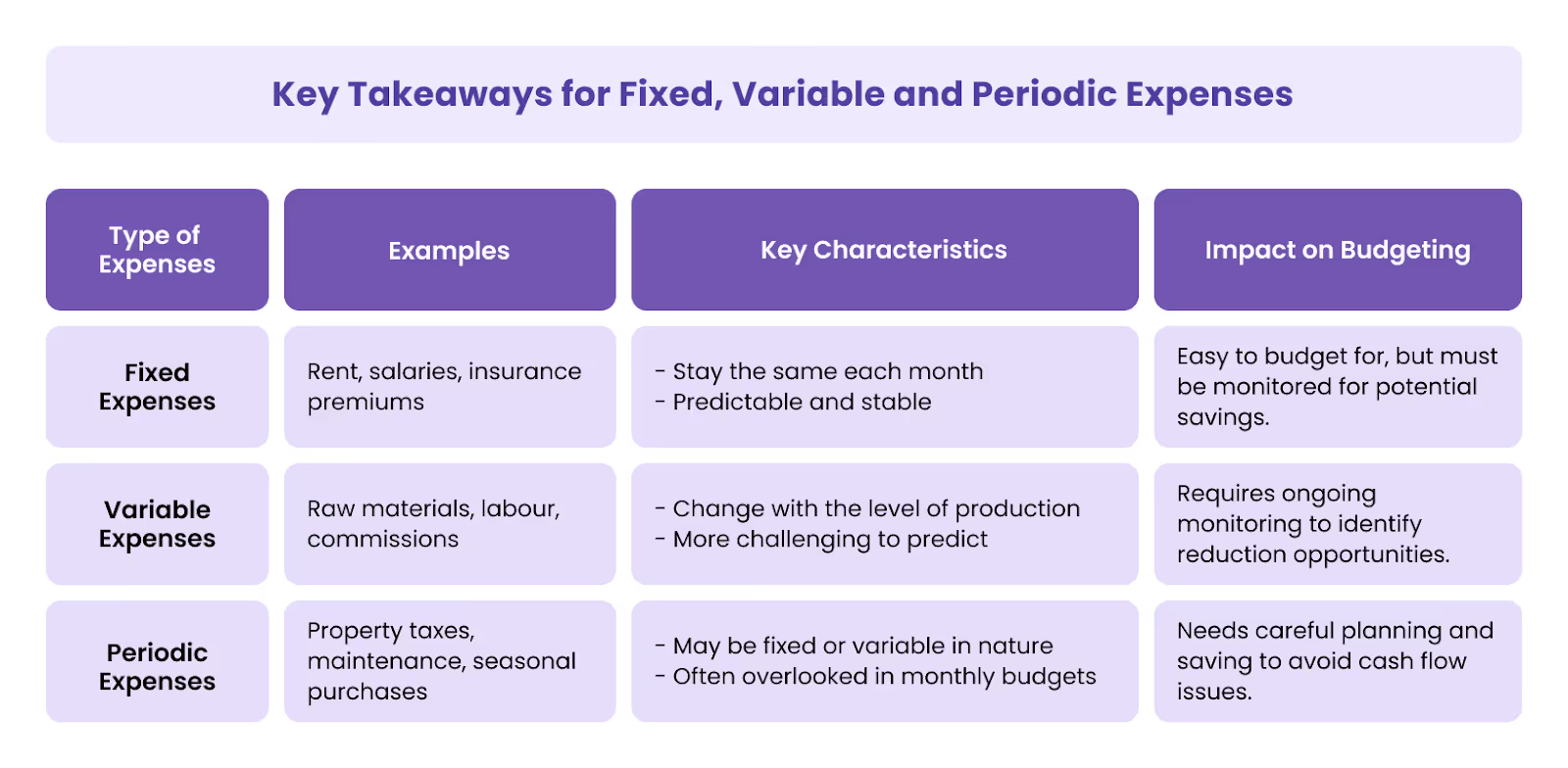

Understanding the differences between fixed, variable, and periodic expenses is essential for business owners to manage their finances and plan their strategies effectively.

Here’s why this distinction is vital:

- Effective Budgeting

Knowing the nature of your expenses helps you create a realistic budget. Fixed expenses, like rent and salaries, are easier to predict, while variable and periodic expenses can fluctuate. This understanding allows you to allocate funds more accurately and avoid cash flow issues.

- Assessing Break-Even Points

Understanding your fixed and variable expenses is crucial for calculating your break-even point. This analysis determines how much you need to sell to cover costs, allowing you to set pricing strategies effectively.

The formula to calculate break-even volume is:

Break - Even Volume = Fixed Cost /Price−Variable Costs

Knowing this helps you make informed decisions about sales targets and marketing efforts.

- Identifying Economies of Scale

Differentiating between fixed and variable expenses can help you identify opportunities for economies of scale. As production increases, your fixed costs are spread over more units, reducing the overall cost per unit. This insight can drive strategic decisions about expansion and efficiency.

- Profit Forecasting

Understanding your cost structure enables you to forecast profits more accurately. By monitoring fixed and variable expense changes, you can project future earnings and adjust your strategies. This is especially important if you plan to reinvest profits or distribute dividends.

- Planning for Periodic Expenses

Periodic expenses, like maintenance or annual taxes, can easily disrupt cash flow if unplanned. You can avoid unexpected financial strain by keeping track of these irregular costs and budgeting for them in advance.A good approach is to review the previous year’s periodic expenses, total them, and divide them by 12 to set aside monthly savings for these costs.

- Strategic Decision-Making

Mastering your expenses empowers you to make informed operational decisions. Whether cutting costs, investing in new projects, or adjusting pricing, having a clear picture of your expenses ensures that your decisions are data-driven and strategic.

- Improving Cash Flow Management

Distinguishing between different types of expenses can improve cash flow management. Understanding when periodic expenses will arise allows you to manage your cash reserves better, ensuring you have the necessary funds available when these costs hit.By clarifying your fixed, variable, and periodic expenses, you enhance your ability to manage your business effectively. This understanding not only helps in maintaining financial stability but also positions you for growth.

Here’s a comprehensive table summarising the key takeaways for fixed, variable, and periodic expenses:

Conclusion

In summary, distinguishing between fixed, variable, and periodic expenses is essential for maintaining healthy business finances. By understanding each type of expense, you can plan more effectively, optimise cash flow, and avoid financial pitfalls that could harm your bottom line. Whether it's predicting monthly rent, adjusting to fluctuating utility costs, or preparing for periodic maintenance, having a clear view of your expenses gives you control over your budgeting and financial planning.

[cta-5]

Managing these costs can be challenging, but you don't have to do it alone. With Alaan's spend management solution, you can easily streamline expense tracking, gain real-time insights, and optimise your budget. Book a demo with Alaan today to see how our platform can help you stay on top of your fixed, variable, and periodic expenses.

.avif)