Are you tired of the constant struggle to manage your business expenses? You're not alone. As businesses evolve, so do their financial operations. In fact, the shift towards automation for expense management is not just a trend but a necessity for efficient financial operations.

This is where expense management software comes into play as a dedicated tool to streamline and automate the process of managing, tracking, and reporting business expenses. This solution transforms a traditionally time-consuming and error-prone expense management process into a smooth, efficient, and accurate operation. However, choosing the right expense management software can be a challenge, especially when there are several options to choose from.

In this blog, we will explore the essential features that the best expense management software should offer including considerations for accounting software compatibility, custom rules, ease of use, and best practices to select the most suitable expense software for your company. Keep reading to learn more.

What is expense management software?

Expense management software is a digital platform that streamlines and automates the process of tracking, reporting, analysing, and managing business expenses in compliance with company policies and tax laws. This solution replaces traditional methods such as manual data entry, sifting through paper receipts, and long approval processes with technology-driven workflows.

From managing travel reimbursements to overseeing operational costs, these systems contribute to well-structured financial records and enable data-informed decision-making. The best expense management software integrates smoothly with your existing accounting solution, ensuring consistent financial transactions and records across all systems. This seamless integration facilitates easy data synchronisation, enhancing the overall efficiency of your financial management.

What is the importance of expense management software?

Expense management software can be a transformational tool for businesses, offering numerous benefits beyond just tracking and reimbursing expenses. Let's understand why you might find it beneficial to adopt the best expense management software for your business:

- Reduce manual errors and save time: Manually managing expenses is prone to errors, from incorrect entries to lost receipts, which can lead to inaccurate financial reporting. Expense management software streamlines the process, automating expense capture and reducing the risk of human mistakes in the general ledger. This saves your finance team valuable time and effort in tracking employee spending.

- Improve compliance and avoid penalties: Staying compliant with tax regulations and company policies can be complex. Expense management software helps you enforce expense policies, track deductions, and ensure accurate reporting. This minimises the risk of non-compliance and costly penalties, such as missing tax deductions.

- Increase transparency and visibility: With centralised expense data, you gain better visibility into your company's spending habits. This helps you identify areas for cost savings, track trends, and make informed financial decisions, aligning with the best practices in business expense tracking.

- Enhance financial control: Expense management software provides real-time insights into your spending, allowing you to monitor budgets, detect anomalies, and prevent unauthorised expenses. This gives you greater control over your finances and helps you make data-driven decisions to optimise your financial processes.

Important features in expense management software

When selecting the best expense management software, you need to consider several key features to enhance the efficiency of your expense management process.

- Centralised dashboard for 360-degree visibility

A centralised dashboard in expense management software is a powerful tool that provides a comprehensive and real-time view of all expenses. This feature consolidates expense-related data into a unified hub, allowing managers to monitor and control spending effectively. It facilitates several key functionalities, such as real-time expense tracking and single dashboard accessibility to all stakeholders. This 360-degree visibility is crucial for strategic decision-making, enabling you to identify trends, spot anomalies, and make informed financial decisions.

- Mobile application to manage expenses on the go

n the modern, fast-paced business environment, the ability to manage expenses on the go is a necessity. A fully functional mobile app for expense management can allow employees to submit expenses from anywhere and at any time, improving efficiency and ensuring timely expense reimbursement. This feature is particularly beneficial for businesses with a mobile workforce, enhancing the user experience by providing easy access through platforms like the app store. The convenience of managing expenses on the go means whether your team is working from the office, from home, or while travelling, they can easily record and submit their expenses.

- Digital receipt capture and upload

The era of keeping track of paper receipts is over, thanks to the feature of digital receipt capture and upload powered by the OCR technology. Employees can simply take a photo of their receipt and upload it to the system, reducing the risk of lost receipts and simplifying record-keeping. It makes reviewing and approving expenses easier, as all necessary information is readily available in digital format. Digital itemised receipts help streamline your record-keeping process by automatically entering the merchant, cost, and tax info and categorising the expenses under the correct heads.

- Pre-defined approval processes

Pre-defined approval processes are a crucial feature in expense management software as they ensure compliance and streamline the approval processes. With custom rules and workflows, you can ensure that employee expenses are compliant with the company policy, helping avoid incurring unnecessary costs. This feature can significantly reduce approval bottlenecks, enhancing the efficiency of the expense management process. It also provides a systematic way of handling all aspects related to corporate cards, including issuance, monitoring, compliance, reporting, and reconciliation.

- Data security and privacy

Robust data security measures are integral to protecting sensitive financial information. Expense management software should provide encryption, access controls, multi-factor authentication, regular security updates, audit trails, and compliance features. These measures prevent unauthorised access from malware or third parties that could manipulate data. They ensure the integrity of the data within the company in a way that is consistent with the organisational risk strategy. Advanced data privacy settings offer you control over who gets to access the company's confidential information.

- Supports corporate cards

Supporting corporate cards is a significant advantage of integrating expense management software with your accounting systems. This allows you to automate reconciliation processes, ensuring accurate and timely tracking of business expenditures. When an integrated platform backs corporate cards, managers gain real-time visibility into company spending, enabling them to make informed decisions, monitor budgets effectively, and identify areas for cost savings. This integration offers several benefits, including improved expense tracking, enhanced margin control, simplified cash flow management, increased efficiency, and improved compliance.

- Integration with accounting systems

Seamless integration with existing accounting systems, such as QuickBooks Online and Zoho Expense, is a key feature of the best expense management software. This integration saves time, reduces manual errors and provides a comprehensive overview of financial data. It ensures that financial data is consistently accurate across both expense management and accounting platforms, reducing discrepancies and enhancing overall reporting accuracy. This integration facilitates adherence to company expense policies by automating approval workflows and flagging potential policy violations.

- Multi-currency support

Multi-currency support is essential for streamlined expense management for businesses operating in different countries. This feature simplifies the reporting process, ensures compliance with local regulations, and eliminates the complexities of manual currency conversions. By automating currency conversion, the best expense management software can save time and reduce errors. It helps ensure accurate and efficient processing of expenses incurred in various currencies. This functionality is especially important for businesses with employees travelling frequently or conducting transactions in the local currency.

- Automatic expense categorisation

Expense management software often includes automatic expense categorisation, which can significantly save time and improve accuracy. This feature automates the process of assigning expenses to specific categories, reducing manual work and the risk of human errors. By using technology-based categorisation, you can ensure consistent and accurate data, leading to more efficient financial analysis and reporting. With automated categorisation, you can obtain better insights into your spending patterns, identify areas for cost savings, and make informed financial decisions.

- Accurate VAT (input/output) calculations

Accurate VAT calculations are crucial for compliance with UAE regulations and maintaining financial accuracy. Expense management software can automate VAT calculations for each transaction, ensuring compliance with FTA rules. This feature eliminates the need for manual calculations, reducing the risk of errors and non-compliance. By automating VAT calculations, you can streamline your tax reporting process and ensure that you are not overpaying or underpaying VAT.

- Real-time reporting and analytics

Real-time reporting and analytics offer actionable insights into your spending patterns. This enables you to make informed decisions and monitor your financial performance. Expense management software offers real-time visibility into your expenses, giving your finance team the ability to track spending as it happens and identify any potential issues. This empowers you to analyse trends, spot anomalies, and make data-driven decisions to improve your financial systems and processes.

How do you choose the right expense management software?

Choosing the best expense management software for your business involves a step-by-step process considering various factors.

- Understand your needs: The primary step in this process is to assess your company's specific expense management needs, including the types of expenses and integration with Enterprise Resource Planning (ERP) systems. Consider factors such as company size, industry, and current expense management challenges. For instance, a small business might have different requirements compared to a large enterprise. Understanding these needs can help you identify the features that are most important for your business.

- Determine the budget: Setting a realistic budget for expense management software is crucial. Considerations include software costs, implementation fees, and potential return on investment. Remember, the most expensive software is not necessarily the best fit for your business. It is about finding a solution that offers the best value for your investment.

- Involve different stakeholders: Involving stakeholders from various departments in the selection process is important. Their input can ensure the software meets the needs of all users. For example, the finance team might prioritise features like reporting and analytics, while the HR team might look for easy integration with existing systems.

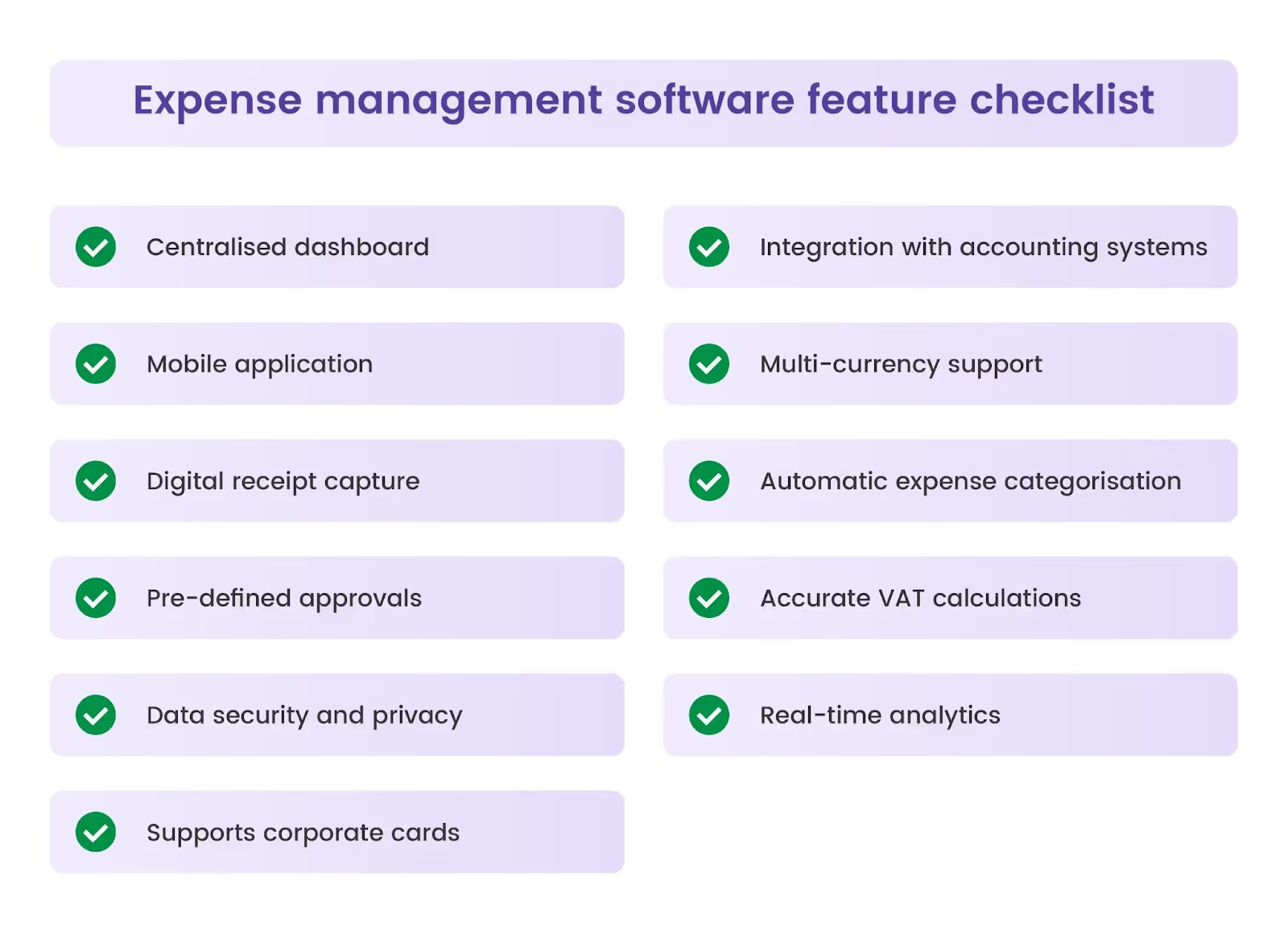

- Evaluate software features: Create a checklist of essential functionalities to evaluate when comparing unique features like user interface, mileage tracking, software integrations, expense capture, and timely reimbursements. Prioritise features based on your company's needs. For instance, if your business operates internationally, multi-currency support might be a top priority.

- Consider scalability and flexibility: As your business expands, the volume and complexity of transactions increase, making scalable expense management solutions essential. Effective expense management software adapts to these changes, ensuring performance and integration with existing systems. By leveraging scalable expense management, you can maintain control, compliance, and efficiency even as your business grows.

- Check compliance and security features: Automated expense management solutions play a crucial role in enforcing compliance by flagging non-compliant expenses, enforcing spending limits, and ensuring adherence to company policies and industry regulations. By maintaining compliance, your company can mitigate risks, avoid penalties, and uphold your reputation and integrity.

- Review vendor reputation and support: Researching and evaluating the reputation of expense management software vendors is important. A reputable provider should have an active customer support system and regularly update its software to respond to new challenges and customer feedback. This ensures that you are investing in a solution that is supported and continually improved.

- Conduct a pilot program: Running a pilot program before a full-scale launch of the expense management software provides you with an opportunity to gather feedback from early users. This feedback can help you identify necessary improvements, assess market viability, and gauge customer acceptance. A pilot program also allows you to test the software's scalability and performance under real-world conditions. It can reveal potential issues that might not be apparent in a controlled testing environment.

- Plan for implementation, training, and periodical reviews: Implementing a new expense management software involves more than just installation. It requires a comprehensive plan that includes training for employees and ongoing reviews. Training ensures that all users understand how to use the software effectively, maximising its benefits. Regular reviews allow you to assess the software's performance, recognise improvement areas, and undertake necessary adjustments. This helps make sure that the solution continues to meet the evolving needs of your company.

Why do you need a comprehensive expense management software evaluation checklist?

Selecting the right expense management software can significantly impact your business's efficiency, financial control, and overall success. A well-crafted evaluation checklist is essential to ensure that you make an informed decision.

Don't miss out on this valuable resource. Our comprehensive checklist will equip you to find the best expense management software for your business and streamline your financial operations.

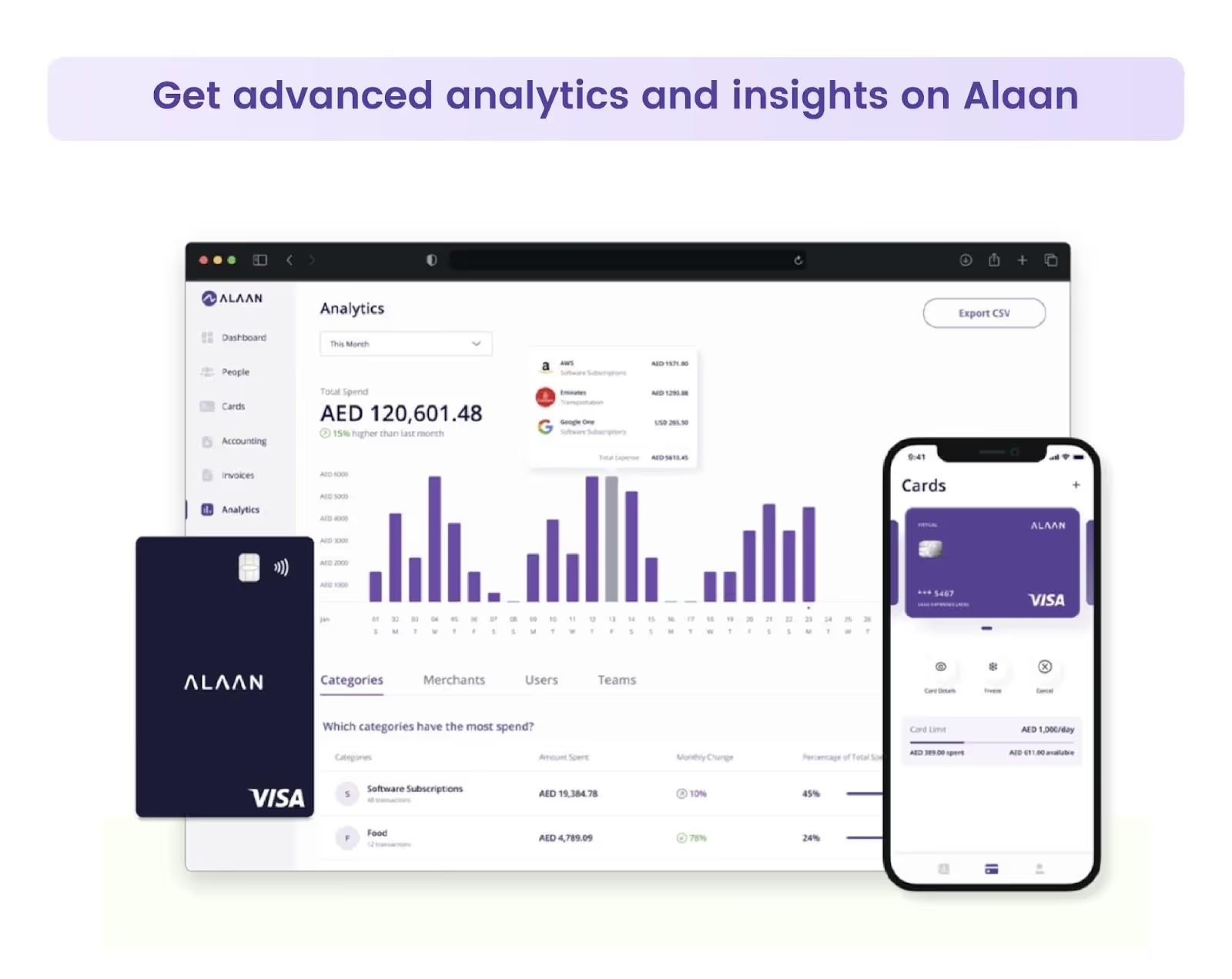

Optimise your expense management processes with Alaan

At Alaan, we understand the importance of efficient expense management in the UAE's fast-paced business environment. That is why we have developed a comprehensive expense management software solution to help optimise your business processes.

- Unlimited virtual and physical corporate cards: At Alaan, one of the standout features of our solutions is the provision of unlimited physical and virtual corporate cards. These cards offer your team the flexibility to make necessary purchases without the hassle of reimbursement processes. This not only helps streamline your expense management processes but also empowers your team to focus on what truly matters.

- Multi-currency support and instant issuance: Our corporate cards support multiple currencies and can be issued instantly to any team member. They can be used for a variety of expenses, including e-commerce, digital ads, SaaS subscriptions, government payments, fuel, and more. This flexibility makes our corporate cards a useful tool for managing your business expenses.

- Automated expense reporting: In addition to our corporate card solutions, our software offers powerful expense management tools that automate the creation of expense reports. This feature, combined with our smart categorisation, which automatically assigns categories based on past entries and credit card statements, makes expense tracking accurate and less time-consuming.

- Digital receipt management: We also offer digital receipt management. This feature allows for easy digital capture of receipts and can automatically parse receipts to create expense report entries.

- Seamless integration: Our expense management software integrates seamlessly with your existing accounting systems, ensuring a smooth flow of financial data and reducing the risk of errors.

Get in touch with our experts to learn more.

.avif)

%2520(1).avif)