Businesses reimburse a wide range of expenses, from everyday office supplies to travel costs and even, in some cases, medical bills. According to a recent survey by GBTA, almost 50% of enterprises that process expense reports internally find setting up expense reports (49%), entering the data (54%), and attaching receipts (55%) as some of the major pain points.

Unsurprisingly, managing employee reimbursements can be a challenge due to the wide range of expenses and the complexities involved. These difficulties can lead to significant time spent on repetitive tasks like report setup, data entry, and receipt attachment. This not only reduces efficiency but also increases the risk of errors. To address these challenges, we have created this comprehensive guide to help you navigate the reimbursement process with ease.

Here, we will cover different types of business expenses eligible for reimbursement, common challenges companies face, and practical tips to streamline your entire expense reimbursement process. Keep reading to learn how to take control of your business spending.

What is expense reimbursement?

Expense reimbursement is a process where your company compensates employees for out-of-pocket spending incurred during their work. These reimbursable business expenses can range from travel costs, meals, and accommodation to office supplies and professional development courses.

Timely reimbursements ensure that your employees are not financially burdened for expenses made on behalf of the business. However, you must ensure that the reimbursed amount (for approved claims) is the same as the expenses incurred by an employee during the specified period.

Here is what a typical expense reimbursement process looks like:

- Spending: Employees use their own money, either cash or card, to cover business-related expenses.

- Documentation: After employees pay for expenses, they have to fill out a detailed expense report form. This report should include all necessary information and receipts attached for every expense.

- Verification: Next, managers review the submitted reports to ensure they comply with company policies and there are no discrepancies. The finance team then conducts a final check for policy compliance and may contact the employee for clarification on certain expenses if needed.

- Approval: Once everything is verified, the expenses are approved for reimbursement.

- Reimbursement: Finally, the employee receives the reimbursement amount back in their account, typically within days (if luck favours) or weeks of submitting the report.

While this process might seem straightforward, it has some shortcomings.

For instance, using personal money for business expenses places an unnecessary financial burden on employees. Reimbursements can also be time-consuming as they require manual intervention at every step, right from paperwork to actual payment. This might lead to delays in releasing the payments, causing frustration among employees.

What is an expense report?

An expense report is a document that itemises the business expenses paid by employees. It serves as a record of out-of-pocket costs that employees have incurred during official work. When employees submit an expense report with the required documents (such as receipts, invoices, and boarding passes) as proof of expenses, they are essentially making a formal request for reimbursement.

Typically, an expense report features the following information:

- Identification details: This includes the name, department, and position of the person submitting the report.

- Date of expense: The date when each expense was incurred.

- Type of expense: This includes expense categories such as travel, meals, office supplies, or professional development courses.

- Amount: This is the actual cost of each expense, along with applicable taxes.

- Receipts: These act as proof of the expense incurred by the employee.

Timely report submissions ensure smoother processing and fewer disputes. Clear and complete reports with supporting documents for every expense allows your finance department to review and approve expense reimbursement requests efficiently.

Which expenses are eligible for reimbursement?

Here are some of the common expenses that are eligible for employee expense reimbursement.

Meals and entertainment expenses

Meals and entertainment expenses for business purposes constitute a significant portion of reimbursable costs. These can include client dinners, business lunches, and meals during business trips.

However, it is important to note that these expenses must be ordinary and necessary, and they cannot be extravagant. For instance, a simple dinner with a client at a local restaurant would typically be covered, but a lavish party at an expensive venue might not be. This will depend on the company’s expense policy.

Business travel expenses

Business travel expenses cover a wide range of costs incurred during local and international business trips. These include:

- Transportation: Airfare, train tickets, and car rentals

- Lodging: Hotels, motels, or other accommodations

- Per diem allowances: Daily allowances for meals and incidental expenses

To keep these expenses reasonable and within policy guidelines, it is important to plan, compare prices, and make use of corporate discounts where available. Any spending over the specified limit must require prior approval from the manager.

Office supplies and equipment

Office supplies and equipment necessary for work also qualify as reimbursable expenses. These can range from basic office supplies like pens and paper to more significant employee purchases like computers, printers, or other essential tools for work.

For high-cost items like a laptop or a photocopier, it is advisable to get prior approval from the concerned manager. This ensures that the purchase is necessary, falls within the company’s budget, and complies with the expense policies.

Professional development expenses

Professional development expenses are seen as an investment in employee growth and can help improve their productivity. Reimbursable professional development expenses can include:

- Training programs: Pursuing courses or workshops aimed at enhancing specific skills relevant to the job.

- Conferences: Attending industry conferences or seminars to learn more about current trends and best practices.

- Certification courses: Enrolling in courses that lead to professional certifications can enhance an employee’s qualifications and value to the company.

The cost of these activities, including registration fees and related travel expenses, are generally reimbursed by the company.

Miscellaneous expenses

These are the costs that do not fit neatly into other categories but can also be reimbursable.

- Uniforms: If the job role requires specific attire, the cost of purchasing uniforms may be reimbursed.

- Safety equipment: Items such as helmets, gloves, or safety boots needed for certain jobs can also be reimbursed.

- Other necessary items: Any other work-related expenses that are essential but not covered in the main categories, such as business-related mobile phone expenses or specific work tools, can also be reimbursed.

Employees must keep all receipts and provide a clear description of the business purpose for each expense to avoid any issues during the expense reimbursement process.

What are the challenges associated with expense reimbursement?

Here are common issues that businesses of all sizes face during the reimbursement process and how they affect both employees and the company.

For employees

- Managing receipts: Managing physical documents can be challenging and time-consuming. Employees spend a lot of time organising receipts, which can lead to inefficiencies and lost productivity. Losing receipts adds complexity to the submission process, making it harder to accurately track and document expenses.

- Long approval timelines: Long approval timelines can significantly delay business expense reimbursements, affecting employee morale. These delays often occur due to inefficient approval processes, lack of automation, or bottlenecks in communication. When reimbursement takes too long, employees may feel dissatisfied, especially those with limited financial flexibility.

- Preparing and submitting expense claims: Preparing and submitting expense claims can be tedious. Employees often need to fill out detailed forms, attach receipts, and ensure all information is accurate. Any mistakes in data entry or missing information can complicate the process, leading to additional back-and-forth with the finance team and slowing down reimbursement.

For employers

- Policy non-compliance: Without proper checks, employees may incur expenses that violate company policy and submit claims for these costs. Such violations, like claiming expenses not covered or exceeding limits, require the finance team to seek explanations from employees, causing process complications and delays.

- Errors and frauds: The risk of errors and fraudulent claims is inherent in the expense reimbursement process. Inaccurate reporting or intentional misrepresentation of expenses can lead to financial losses for the company.

How to streamline your expense reimbursement?

Here are some actionable tips to help you streamline your expense reimbursement plan:

Have a comprehensive reimbursement policy

A clear and comprehensive policy is the foundation of every expense reimbursement arrangement, as it defines the rules that all employees must follow. This policy should define which expenses are reimbursable, explain the spending limits, and outline the steps for submitting and approving expense claims. It is important to regularly review and update expense policy to ensure it remains relevant and effective.

Use corporate cards

Corporate cards offer a hassle-free way to manage employee business expenses. They eliminate the need for employees to use their personal funds and then seek reimbursement.

Additionally, corporate cards offer several other benefits that can streamline your expense management process:

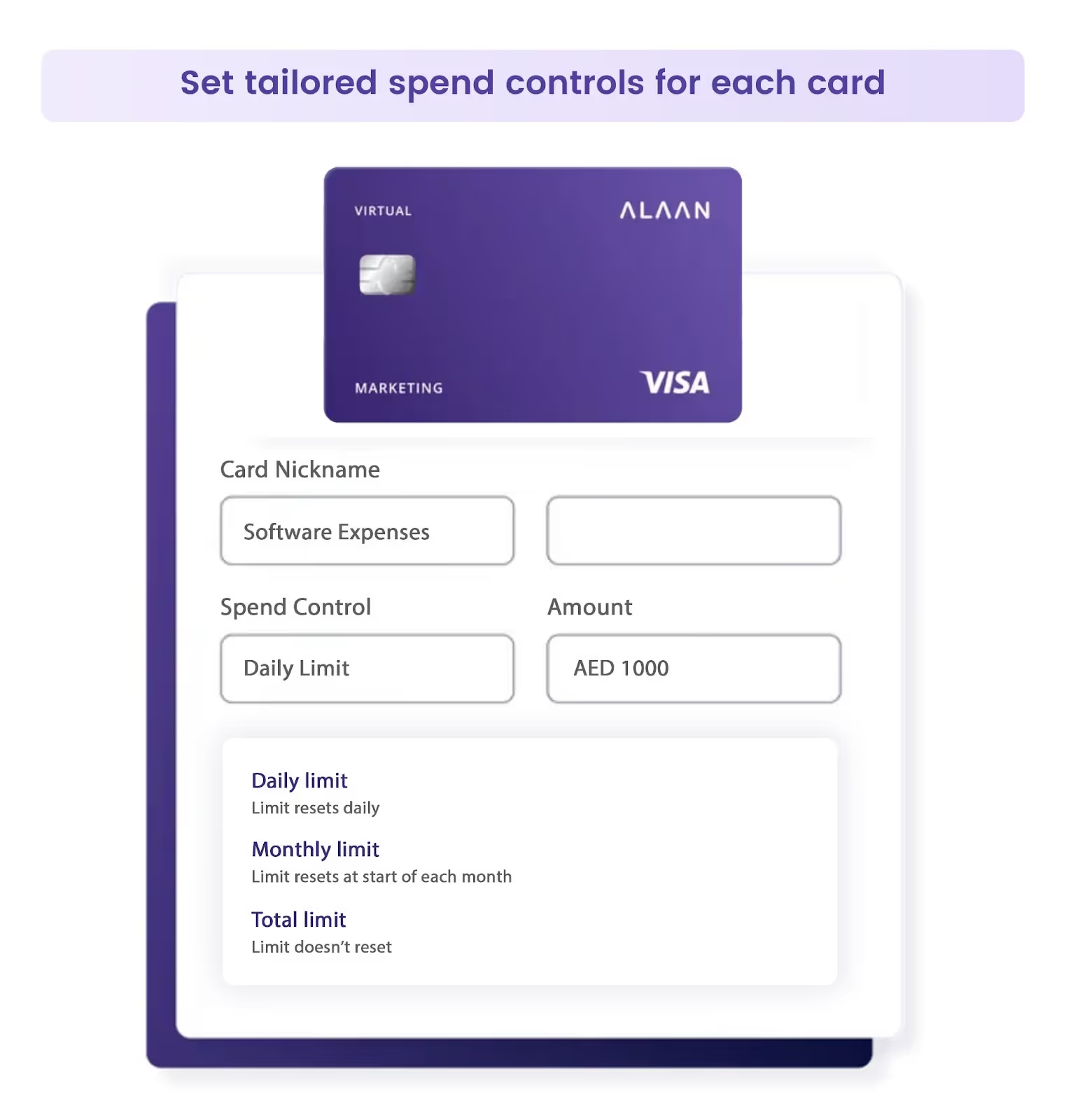

- Customised spending limits: You can set spending limits for each card, ensuring expenses stay within the allocated budget.

- Streamlined approval process: Transactions can be pre-approved or monitored in real time.

- Policy compliance: With the ability to monitor transactions in real-time, you can ensure that all expenses comply with the company’s expense policy, preventing any policy violations.

- Easy issuance: Corporate cards, both virtual and physical, can be easily issued to employees. Virtual cards are available instantly, while physical cards are delivered within 3-5 days. For example, at Alaan, we issue physical cards within 3-5 business days.

Integrate spend management software

When choosing a corporate card, it is beneficial to opt for providers that also offer spend management software. Such software can automate and streamline your expense tracking and reporting processes with features such as:

- Receipt capture: Employees can capture and upload receipts instantly using the linked mobile app.

- Automatic expense recording: Transactions are automatically recorded and categorised, reducing manual entry errors.

- Instant visibility into spending: Real-time dashboards provide insights into company spending, helping you identify trends and manage budgets more effectively.

By seamlessly integrating with your accounting systems, our software offers you better control over your financials.

Ensure clear communication with employees

Clear communication regarding expense policies and procedures is essential for smooth reimbursement. When employees are well-informed about the procedures, they can follow them correctly, reducing the likelihood of errors and delays.

Consider the following tips for effective communication:

- Use internal messaging platforms: Share updates and reminders about expense policies using tools like Slack or Microsoft Teams.

- Conduct workshops: Regular training sessions can help employees understand the reimbursement process and stay compliant with formal policies.

- Provide easy access to information: Make sure employees can easily access the expense policy and related documents through the company intranet or shared folders.

Optimise your expense management with Alaan corporate cards

Managing business expenses can indeed be a complex task. At Alaan, we have designed our corporate cards to make the entire process efficient and less burdensome for you.

Here is how we can help eliminate reimbursements and simplify expense management:

- Eliminate the need for reimbursements: Our corporate cards allow your employees to charge business expenses directly to the company account, eliminating the need for the traditional reimbursement process. This not only saves time but also reduces the administrative workload for your finance team.

- Customisable spending controls: With our corporate cards, you can set customised spending limits and restrictions for each card. This ensures that expenses stay within budget and comply with company policies. For example, you can set weekly or monthly limits or restrict spending to specific categories, such as travel or office supplies.

- Virtual and physical cards: At Alaan, we offer both virtual and physical cards, providing flexibility for various types of expenses anywhere, at any time. Both types of cards offer the same robust features, ensuring all business expenses are tracked and managed effectively.

- Integration with accounting software: At Alaan, our corporate cards are part of a comprehensive solution. Unlike traditional credit cards, our offering includes integrated expense management software that seamlessly connects with leading accounting platforms such as QuickBooks and Xero. The key benefit of this integration is the automation of the expense reporting process, reducing the need for manual data entry.

By switching to our corporate cards, you can simplify your expense management and focus on what matters most – growing your business.

Contact Alaan to learn more about corporate card solutions.

.avif)