Most businesses in the Middle East deal with petty cash problems daily. From chasing employees to submit receipts to reconciling each expense manually - there is a lot of unnecessary manual work that finance teams end up doing.

Thankfully, we now have digital solutions that can streamline business expenses and bring in better financial visibility and control. In today’s blog, we'll explore common petty cash problems and how modern solutions are solving these to ensure smoother financial operations. Read on!

Challenge 1: Financial Control In Businesses With Multiple Branches

Managing petty cash in a single location is challenging enough, but throw in numerous branches, and things can quickly spiral out of control. The traditional method of physically transporting money creates a constant security risk and logistical nightmare. Lost or stolen funds become a real possibility, while the burden of tracking tiny transactions across diverse locations falls heavily on the custodian's shoulders.

Digital bank transfers, while seemingly safer, add another layer of complexity. Juggling multiple branch accounts and their constant monitoring becomes tedious, making reconciliation a herculean effort.

These issues disrupt business operations, opening doors to financial mistakes and inefficiencies. It's clear that the traditional system doesn't scale, leaving businesses with the pressing need for a more secure, streamlined, and manageable solution.

Solution: Prepaid Corporate Cards

Corporate Cards offer a powerful solution to streamline finances and enhance security across multi-branch operations.

- Corporate Cards allow for one-click loading and unloading of funds, eliminating the need for physical cash transfers.

- Companies can block or unblock cards as needed, providing enhanced security and control over fund access.

- Companies can set granular spending limits and restrictions for each card, based on specific criteria, ensuring responsible use of funds.

By using corporate cards, organizations can centralize expense tracking and customize control across various branches or locations.

Here’s how Al Barari transformed its expense management with Alaan’s Corporate Cards.

Al Barari, a renowned real estate developer in UAE, encountered challenges in managing spend across its entities, with multiple employees making purchases across different business entities. This complexity, compounded by navigating various card systems and a mix of personal and company credit or debit cards, hindered currency flow planning.

Time-consuming petty cash management, reimbursement planning, and monthly accounting tasks prompted the need for a more efficient solution.

That’s when Al Barari partnered with Alaan to implement a centralized spend management platform. This simplified workflows while maintaining entity separation. All expenses are now managed through the Alaan card.

Challenge 2: Spend Leakages, Fraud, and Policy Non-Compliance

While handling small amounts might seem easy, the reality often involves pesky problems like spend leakages, and fraud, causing more challenges for your finance team.

Using physical cash or an employee’s personal credit card for petty cash management can lead to issues like:

- Unauthorized spending

- Non-compliant expense claims

- Expense policy violations

- Delayed petty cash reconciliations

- Messy financial statements

- Unclear transaction tracking

- Confusing petty cash balance sheets, to name a few

Solution: An Integrated Corporate Card & Expense Management Platform

Organizations can leverage expense management software in confluence with corporate cards to plug spend leakages happening while managing petty cash. This integrated approach helps with:

- Eliminating Cash Disbursement: By using Corporate cards for minor expenses, businesses eliminate the need to manage multiple bank accounts for cash disbursement to various branches.

- Compliance With Expense Policies: A good expense management software usually has an inbuilt approval workflow and policy compliance feature. Businesses can directly configure their expense policy into the system, making it easy to flag out-of-policy expenses before they happen.

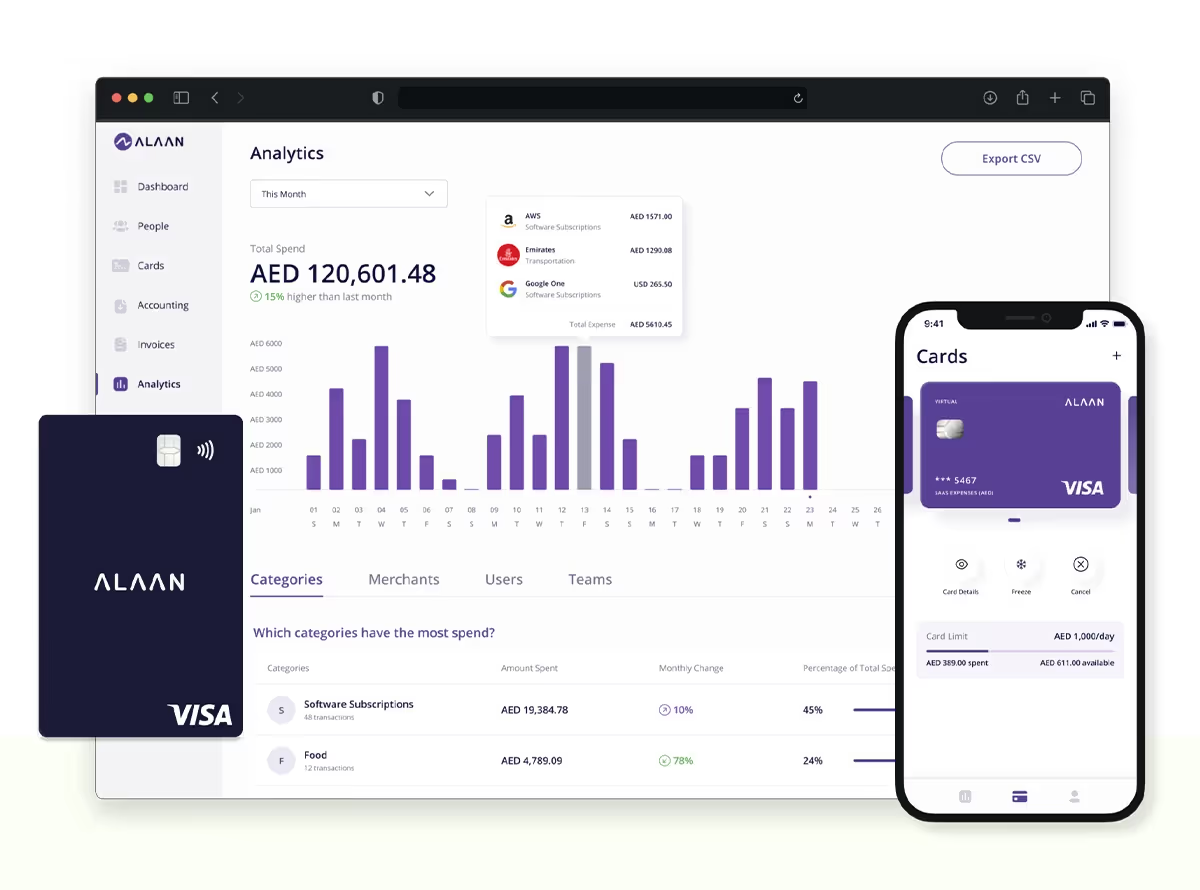

- Real-time Visibility on Business Spend: Expense management software analyses millions of data points to identify trends and stop wasteful spending. The centralized visibility into business spend and plug-and-play dashboard allows finance leaders, CFOs, and business heads to analyze expense data and allocate future budgets.

Using this comprehensive approach to spend management, organizations can gain complete visibility over expenses, effectively control money leakage, and maintain financial integrity in petty cash accounting.

Challenge 3: Inaccurate Expense Filing

Traditional petty cash processes often involve a lot of work, like sending paper receipts to the main office and manually recording expenses in the petty cash log. This old-fashioned way can cause reimbursement delays and expense filing mistakes that can be annoying for both employees and the finance team.

Solution: OCR Technology Powered Expense Solutions

By automating expense filing, finance teams can save a lot of time that they would have otherwise spent chasing employees for reimbursements and manually reconciling expenses.

Alaan automates the expense filing process using Optical Character Recognition (OCR) technology. With this, employees can capture invoices, receipts, and bills in a single click, eliminating the need for manual data entry.

The software automatically captures critical information such as VAT details, amount, date, and location, enhancing accuracy and speeding up the expense filing process.

Challenge 4: Tedious Expense Reconciliation?

Another significant challenge in petty cash management is the considerable time spent on reconciling transactions. Under traditional settings, finance and accounting teams have to manually check each data entry, verify the business expense, and approve the transaction.

This becomes even more difficult for businesses with multiple locations. Also, post-expense reconciliation highlights errors but does nothing to prevent it.

Solution: Platforms Offering 1-Click Reconciliation

Once employees start using Alaan’s corporate credit cards all the expenses are recorded automatically in the system. The one-click reconciliation feature, automatically reconciles invoices with card statements, ensuring accurate and faster reconciliation.

Challenge 5: Accounting Errors and Budgeting Issues

Strategic decisions, budgets, and forecasts hinge on precise cash-flow visibility, a factor often challenging for companies to attain. Without robust spend management solutions, organizations do not have real-time visibility on business expenses.

Furthermore, manual expense management is riddled with accounting errors due to insufficient documentation and inefficient processes.

Solution: Real-time Data Visibility & Control

Corporate cards and spend management platforms also provide real-time insights into spending patterns. With a plug-and-play dashboard, finance teams can analyze expenses by department, expense type, and other criteria. Real-time data visibility leads to better financial planning and control. Based on data insights, finance teams can allocate budgets and plan for future expenditures effectively.

In a nutshell, robust expense management software like Alaan offers a solution to all your petty cash problems. If you haven’t yet explored how such a solution can transform your expense management process, how about Booking a demo with our product specialists today?

.avif)